Throughout the selling process, lead qualification is pivotal to closing deals. For teams selling to pharma and research accounts, the complexities of qualification are several degrees of difficulty greater than most other B2B sales teams. Particular scientific and medical program details are a must, in addition to corporate information and timing signals. The time and effort to qualify these leads is a significant lift for your team.

Designing an efficient and robust process for lead qualification will help reduce this workload to a manageable level and should pay off in spades for your sales reps. Using a novel, fully-integrated life science intelligence solution, you can modernize your lead qualification process, reducing your team’s time by hours every week. Leveraging the power of artificial intelligence will amplify the efforts of your sales team, allowing them to qualify more leads than ever before. This game-changing technology is an easy productivity multiplier.

Though sales processes vary greatly, some steps can’t be missed if you want to ensure a smooth transition or close. Here are the steps that represent best practices for life science and biotech teams:

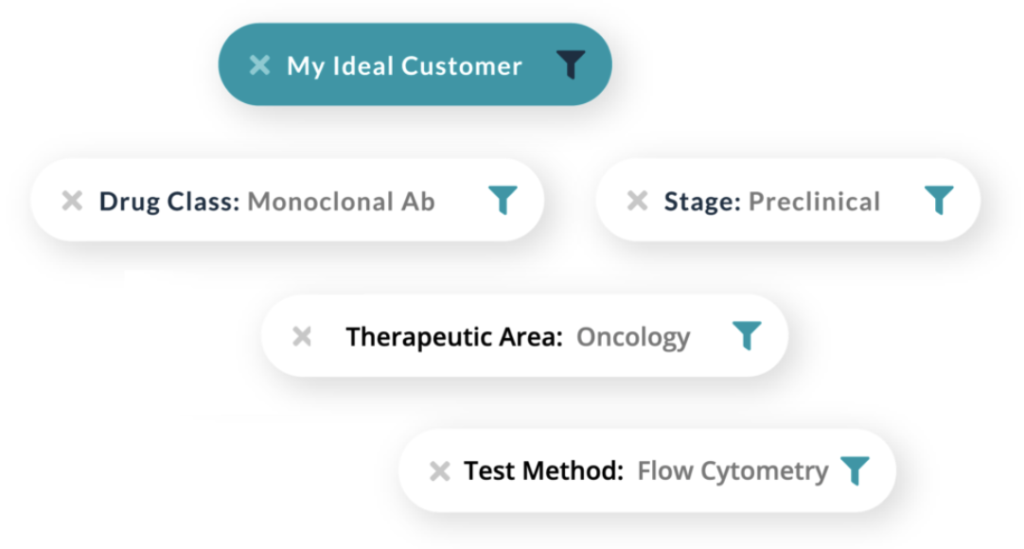

1. Establish your ideal customer profile (ICP)

Each member of your sales team needs to have a clearly defined ICP, so they know precisely which customers to target. For companies targeting pharma and research organizations, the ICP will include firmographic details, plus specific research and drug program parameters, including stage, disease state, sample type, test methods, biomarker, and drug type. Because there are so many parameters, the automation that AI delivers to this process is transformational. Your sales reps will need to define and ID the roles and expertise of prospects at those accounts, which this software can also facilitate.

2. Research your target accounts in great detail

Instead of manual, ad hoc research, an AI solution purpose-built for commercial teams targeting pharma and research organizations will speed up your reps’ research. The software analyzes millions of pieces of biomedical and business evidence to provide insights about any relevant organization and its people. Combining press releases, publications, research and drug program data, conference abstracts, and numerous other sources, it provides insights about your prospects, specific to the companies and programs they’re involved with.

Your team will need to conduct systematic research:

a. Technical fit

Testing criteria, such as test method, sample type, and biomarkers help you match your technology portfolio. Criteria like disease state, drug class, mechanism of action, or development stage help you find pharma and research programs that match exactly any of your products or services.

b. Funding info

Recent funding rounds, stock activity, and grants are all critical indicators of organizational health. A financially unstable organization may purchase today but may not be the best partner in the long run.

c. General organizational info

Obtain a snapshot of the business—headquarters, headcount, and market share. Research the problem the organization needs to address and whether they have a differentiated or innovative solution to a pressing need, as this will be key to their customer acquisition and continued funding.

d. Look for positive growth signals.

Headcount growth and site expansions are strong growth indicators, but in life sciences, many others may be overlooked during qualification. Are they hiring key R&D or commercial leaders? Are they launching new research programs, clinical trials, or product lines? Corporate acquisitions are of particular interest, as they indicate the company’s strategy for growth and market capture.

e. Check out negative growth signals as well.

Lack of funding and poor stock performance are obvious signals, but other indicators, like layoffs, may not be as easy to uncover. Not all companies have to disclose layoffs, or they may complete them in small groups over time so they can be exempt from public disclosure. Look for changes in headcount from year to year.

See how Amplion amps up your sales prospecting. Automatically.

3. Qualifying questions

Most sales teams utilize a framework for qualification that includes some of the previously mentioned research, along with qualifying questions. But should you SPIN, BANT, or make a PACTT? Do you need a CHAMP or a MEDDIC?! Choosing a framework that best aligns with your company and customers will help keep your sales reps from wasting time on the wrong prospects and ensure they don’t miss any critical questions.

a. Problems to be solved

Everyone has a challenge or something they need to overcome using your products/services, or they don’t need you. First things first.

b. Current solutions

What are you competing against—nothing, ad hoc solution, or competitive offering? What’s not working?

c. Why now?

Did they reach a tipping point, get a new leader, or maybe budget or headcount is available? Is there a new goal they need to achieve? Discussions around timeline should surface here as well.

d. Success profile

What will the solution need to do to be considered successful? Understanding how the prospect will measure success is a key that unlocks the door to the customer relationship in the long term. If you don’t know the answer to this question going in, you’ll likely learn it the hard way when the customer churns. Get out in front of this.

e. Budget allocation

This can be a tough talk. No one wants to tell you what they can afford, but people are always willing to tell you what they can’t afford. This will be an even tougher conversation if you’re selling to price and not to value. Make sure you excite your prospect with your differentiators like innovation, service, support, and ROI.

f. Decision-makers

Who’s who in the zoo? Capital equipment and complex services can be long sales cycles with multiple departments weighing in. Don’t ask the right questions here, and you may find yourself waiting for that PO indefinitely.

g. Next steps

Moving the sale forward usually means a fair amount of follow-up, answering questions from various decision-makers, and documents passed around. But it’s your opportunity to build lasting trust and rapport with your soon-to-be customer. Buying decisions can weigh heavy on your prospects, and you can help alleviate worries and instill confidence in choosing your solution. Consistency, courtesy, and compassion will go a long way toward helping the opportunity move forward.

Now that your team has a qualification framework coupled with a modern technology solution for qualifying leads, they’re going to be unstoppable. Knowing which leads are likely to convert will help smooth your deal pipeline and increase your team’s chances of success.

And remember, just because a lead may not be qualified now doesn’t mean they aren’t worth monitoring for new timing signals. The life science industry moves quickly, and IPOs, mergers, acquisitions, or new programs can change the outlook significantly.